أثار ظهور المدرب باتريك كلويفرت مع نخبة من اللاعبين المجنسين من أصول هولندية اهتمامًا كبيرًا بكرة القدم الإندونيسية. مؤخرًا، نشرت صحيفة الغارديان البريطانية تحليلًا حول سياسة التجنيس في كرة القدم الإندونيسية، مشيرة إلى تصريح لافت لللاعب دuy مạnh.

قام منتخب إندونيسيا بإقالة المدرب شين تاي يونغ لضم المدرب الهولندي باتريك كلويفرت (الصورة: جيتي).

إندونيسيا واستراتيجية التجنيس

استخدمت الغارديان تصريح اللاعب دوي مانع للتعليق على المنتخب الإندونيسي: “أحيانًا نمازح بعضنا ولا نعرف إذا كنا نلعب ضد منتخب إندونيسيا أم هولندا”. هذا التصريح يعكس حقيقة أن تشكيلة إندونيسيا الحالية تحتوي على العديد من اللاعبين من أصول هولندية، مما يجعلها تبدو وكأنها “نسخة مصغرة من هولندا”.

يُعتبر استبدال المدرب شين تاي يونغ الناجح بباتريك كلويفرت مقامرة كبيرة لكرة القدم الإندونيسية. لكن هذا القرار لم يكن عشوائيًا. يحتاج المنتخب الإندونيسي حاليًا إلى مدرب يمكنه التواصل بفعالية وفهم ثقافة اللاعبين من أصول هولندية.

الإنجازات والتحديات

في المباراة الأخيرة، هزم المنتخب الإندونيسي السعودية في الجولة الثالثة من تصفيات كأس العالم 2026 بفضل مساهمة 8 لاعبين من أصول هولندية. هذا يدل على تحسن الفريق السريع، لكنه أيضًا يفرض تحديات كبيرة على شين تاي يونغ. واجه صعوبة في التواصل بسبب عدم إجادته الإنجليزية أو الهولندية، وغياب المترجم جعل الأمور أكثر تعقيدًا.

أقر رئيس اتحاد كرة القدم الإندونيسي، إريك طوهر، بأن الفريق بحاجة إلى مدرب يمكنه تنفيذ الاستراتيجيات بشكل أفضل والتواصل بفعالية مع اللاعبين. هذا أدى إلى قرار استبدال شين تاي يونغ بباتريك كلويفرت.

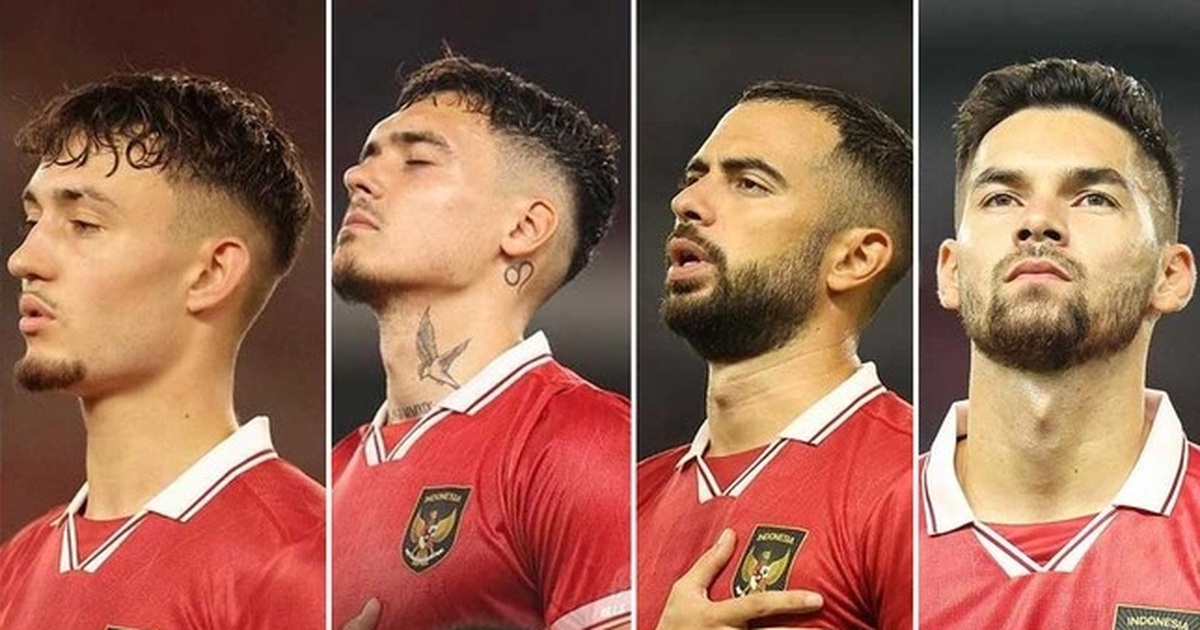

يتحول المنتخب الإندونيسي تدريجيًا إلى “نسخة صغيرة من هولندا” (الصورة: جيتي).

الجدل المحيط

يعتقد البعض أن المدرب شين تاي يونغ تعرض لمعاملة غير عادلة. حتى ابنه، شين جاي ون، أكد أن المنتخب الإندونيسي لن ينجح بدون والده. حتى الرئيس الإندونيسي السابق، جوكو ويدودو، أعرب عن حبه للمدرب الكوري الجنوبي.

ومع ذلك، فإن الاعتماد الكبير على اللاعبين المجنسين أثار جدلًا واسعًا. هل يمكن أن يكون فريق مليء باللاعبين الذين ولدوا ونشأوا في الخارج مصدر فخر حقيقي؟ هذا سؤال كبير تحتاج كرة القدم الإندونيسية للإجابة عليه.

مستقبل كرة القدم الإندونيسية

يُتوقع أن يجلب باتريك كلويفرت تغييرًا إيجابيًا للمنتخب الإندونيسي. بخبرته الكروية العالية وسمعته، قد يتمكن من إقناع المزيد من اللاعبين من أصول هولندية بالتخلي عن حلم تمثيل هولندا والانتقال للعب لإندونيسيا.

إذا نجحت إندونيسيا في التأهل لكأس العالم، سيتم اعتبار باتريك كلويفرت وإريك طوهر أبطالًا. ومع ذلك، سيأتي هذا النجاح مع تساؤلات حول استدامة استراتيجية التجنيس.

الخلاصة

تتعرض كرة القدم الإندونيسية لمرحلة تحول قوية مع ظهور اللاعبين المجنسين من أصول هولندية والمدرب باتريك كلويفرت. لكن التحدي الأكبر لا يتعلق فقط بالأداء داخل الملعب، بل أيضًا بالتوازن بين استراتيجية التجنيس وتطوير اللاعبين المحليين. فقط عند حل هذه المشكلة يمكن لإندونيسيا بناء كرة قدم قوية ومستدامة.