1. Reducing the Minimum Years of Social Insurance Contributions for Pension

According to the 2014 Social Insurance Law, workers needed to contribute for a minimum of 20 years to be eligible for a pension. However, with the amendments introduced by the 2024 Social Insurance Law, this requirement has been reduced to 15 years. This change brings numerous benefits, especially for workers with short careers or those facing difficulties in maintaining 20 years of contributions.

1.1. Benefits of Reducing Contribution Years

Reducing the minimum years of social insurance contributions broadens the benefits for more workers, particularly those with low incomes or working in high-risk industries. Additionally, it encourages workers to continue contributing even after they meet retirement eligibility, enhancing financial security in their post-retirement life.

1.2. One-Time Benefit Upon Retirement

The 2024 Social Insurance Law also introduces a one-time benefit upon retirement. Workers who have contributed for at least 15 years will receive this benefit. The amount is calculated based on the average salary used as the basis for social insurance contributions. Specifically:

- The one-time benefit is equal to 0.5 times the average salary used as the basis for social insurance contributions for each year contributed beyond the statutory retirement age.

- If workers continue contributing after reaching retirement eligibility, the one-time benefit doubles, meaning 2 times the average salary used as the basis for social insurance contributions for each year contributed beyond the statutory retirement age.

2. Expanding Compulsory Social Insurance Participants

The 2024 Social Insurance Law not only reduces the minimum contribution years but also expands the group of compulsory social insurance participants. This includes:

- Business owners of registered business households.

- Non-professional村干部

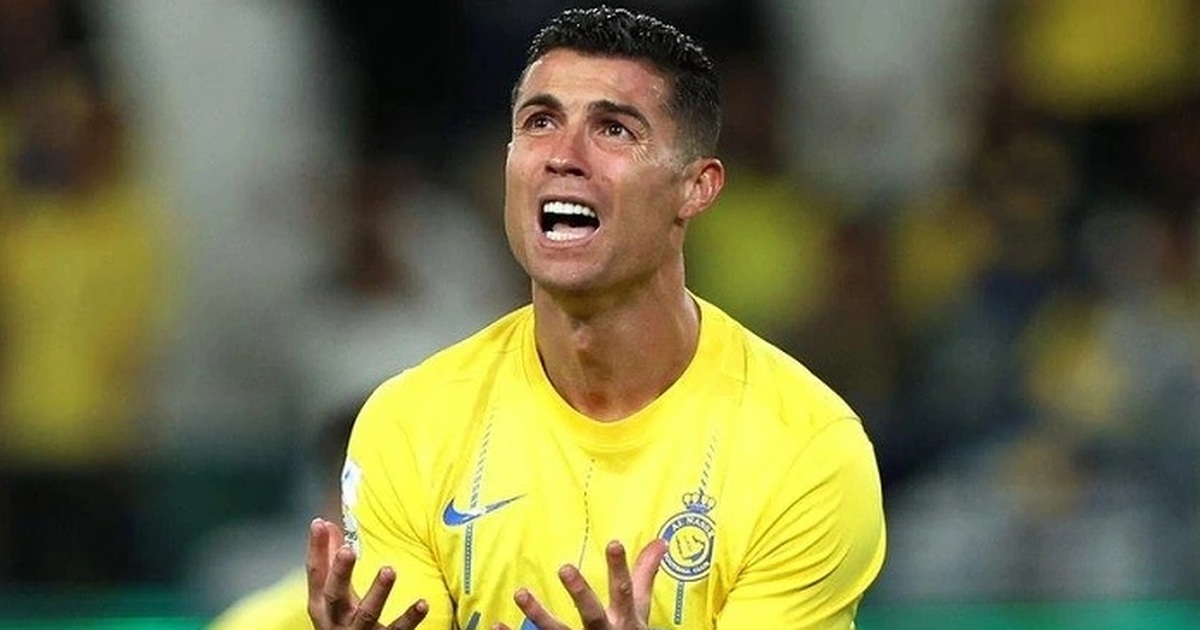

Ronaldo scores at age 40 helping Al Nassr win 5th consecutive match – 1

Ronaldo scores at age 40 helping Al Nassr win 5th consecutive match – 1

Ambulance stuck at the intersection due to the Fortuner not yielding

Ambulance stuck at the intersection due to the Fortuner not yielding