Cuộc đời thật lắm trái ngang, cớ sao đang ngồi yên Jack lại bị réo tên thế này? Để xem, bộ ba Tùng – Jack – Kay Trần liệu có át vía bộ ba Tùng – Trâm – Tú về độ rầm rộ drama không nhé!

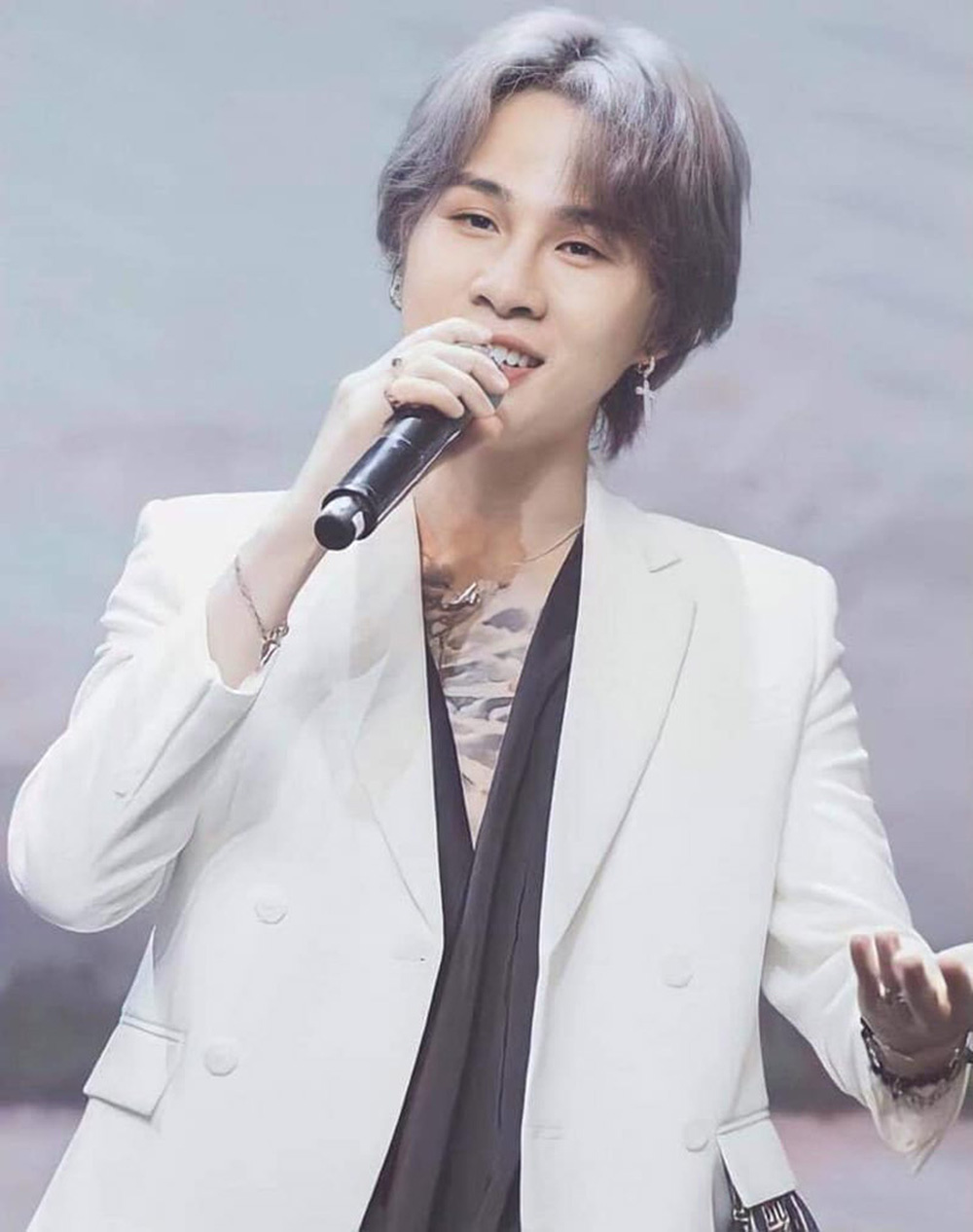

Đầu tiên là cơ duyên giữa Sơn Tùng và Jack khi trùng style suit trắng, tóc bạch kim bồng bềnh và lộ hình xăm ở ngực rất chi là lãng tử. Nhìn Jack, dân tình thi nhau nhìn lên “sky” và hô vang Sơn Tùng M-TP!

Trùng gì khó hơn nữa đi nào: Xin thưa giày Jacno Chelsea Boot đến từ Celine có giá hơn 22 triệu được mix với suit trắng tinh tươm rất là sinh đôi

Cặp song sinh Tùng – Jack hồi đó còn chưa ngã ngũ thì mới đây, Kay Trần vội vã lao vào để cho ra bộ ba nhì nhằng chung style. Mà kể cũng lạ, chưa nguôi style nhang nhác chủ tịch Tùng, Kay đã vội vàng giống Jack đến lạ lùng.

Câu chuyện hi hữu này là do kiểu tóc của gà cưng nhà M-TP Entertainment mà ra. Chưa kể, cách phanh áo đậm hương hoa hải đường cũng khiến netizen ngỡ ngàng trong thảng thốt: Ảo thế!

Áo hoa nhang nhác style, chỉ là… chênh mỗi cái giá

Một số bình luận “chả có ý gì” từ netizen:

– Giống ghê

– Ảo thế!

– Cảm thấy Kay Trần nay mất chất

– Thôi đi mấy má, Kay Trần đẹp trai hơn nhiều!

– Hai ông này thấy hài hài như nhau

– Jack đâu có mlem giống Kay

– Nói thật chứ Jack ăn điểm hơn

Ảnh: Sưu tầm